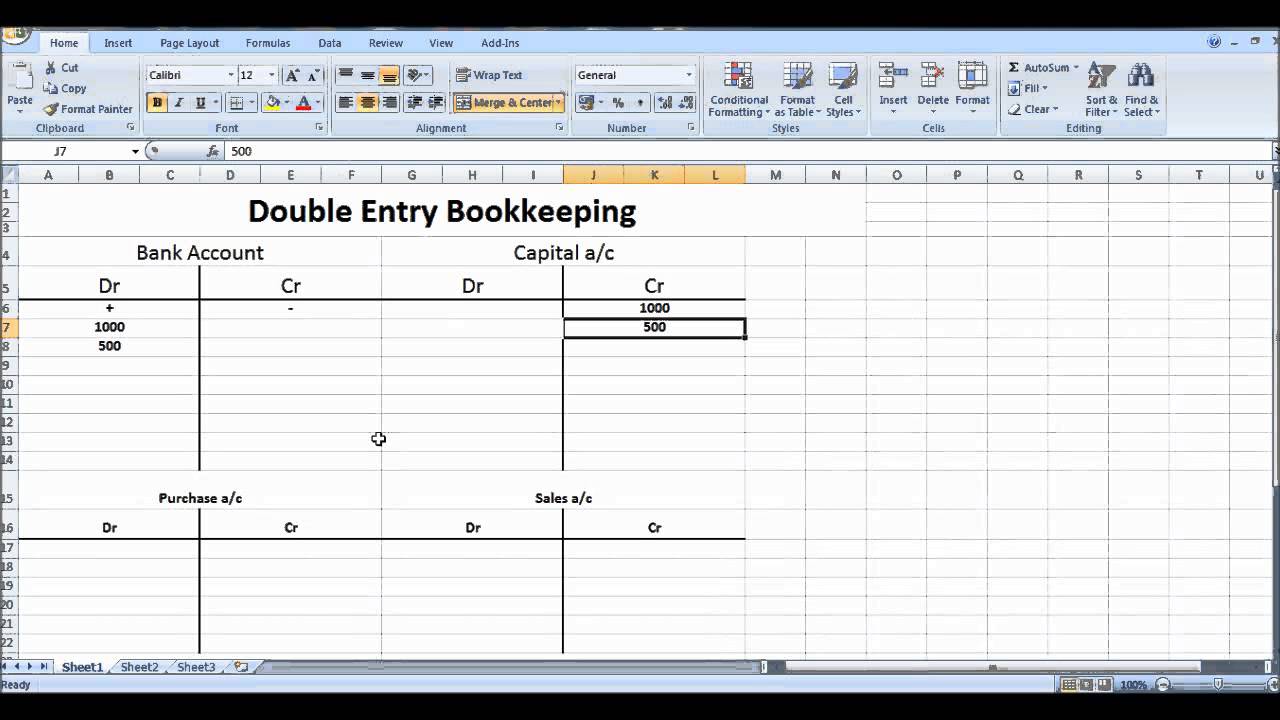

Both sides of the equation increase by $10,000, and the equation remains balanced. In this case, assets (+$10,000 in inventory) and liabilities (+$10,000) are both affected. Let’s take a look at the accounting equation again: Because you bought the inventory on credit, your accounts payable account also increases by $10,000. In this case, the asset that has increased in value is your Inventory. Let’s say you just bought $10,000 of pet food inventory on credit. In this example, only the assets side of the equation is affected: your assets ( cash) decrease by $3,000 and your laptop assets increase by $3,000, and the equation remains balanced. If at any point this equation is out of balance, that means the bookkeeper has made a mistake somewhere along the way. Under double-entry accounting, every debit always has an equal corresponding credit, which keeps the following equation in balance:Īccountants call this the accounting equation, and it’s the foundation of double-entry accounting. So you have to adjust both the cash and laptop accounts in your books: Account

Under double-entry accounting, you would make two entries: you trade one asset (cash) for another asset (laptop).

#Doubl entry bookkeeping examples pro

Let’s say you buy a brand new $3,000 MacBook Pro for your recently-launched blockchain dog food startup. In a nutshell, the double-entry method lets you do modern accounting. Then you could start to think about how you would change your business activities.” “You could itemize the profits in each account, so you knew which products you were doing well in and which you weren’t. “It was just a whole revolution in the way of thinking about business and trade,” writes Jane Gleeson-White of the popularization of double-entry accounting in her book Double Entry. Unlike single-entry, the double-entry system provided accountants with enough information to create all of the major financial statements, including income statements, balance sheets, statements of cash flows, and statements of retained earnings. Noting these flaws, a group of accountants-in 12th century Genoa, 13th century Venice, or 11th century Korea, depending on who you ask-came up with a new kind of system called double-entry accounting. Single-entry doesn’t track assets or liabilities, is prone to mistakes, doesn’t tell you much about the state or health of your business, and is the accounting equivalent of carrying around a velcro wallet-fine when you’re a kid, but not very secure, or reputable, when you’re older. It’s quick and easy-and that’s pretty much where the benefits of single-entry end. If you’re a freelancer or sole proprietor, you might already be using this system right now. Single-entry accounting involves writing down all of your business’s transactions (revenues, expenses, payroll, etc.) in a single ledger.

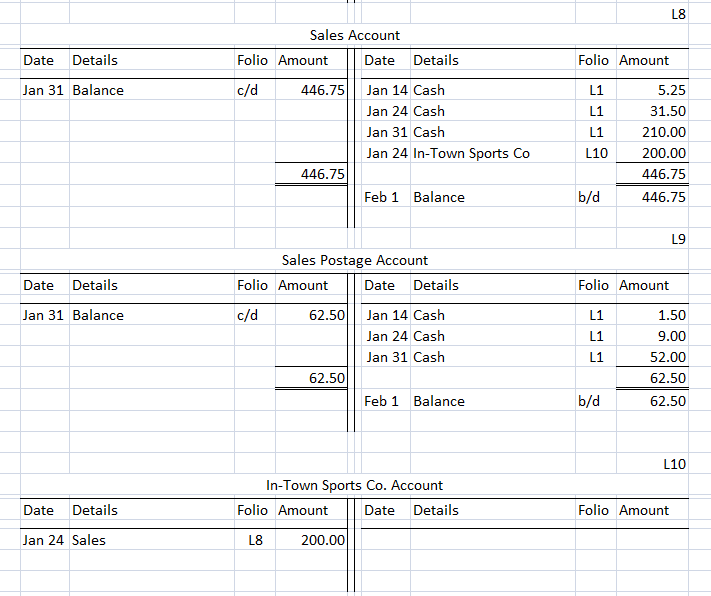

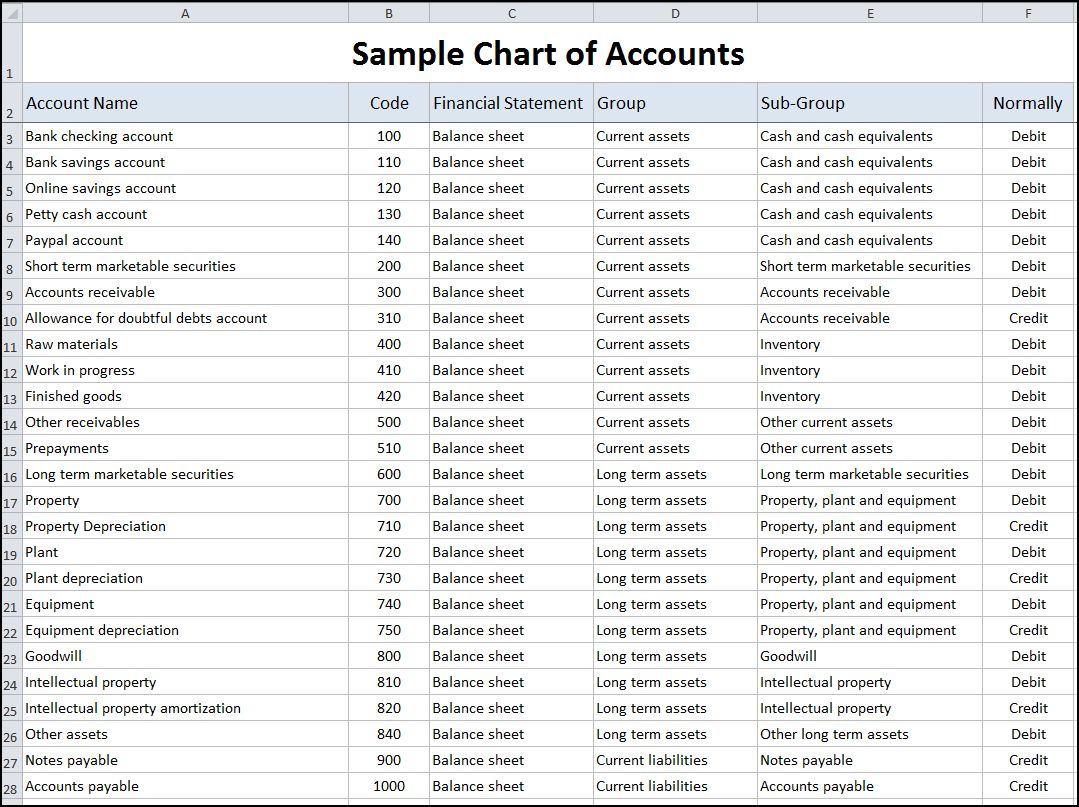

Recording transactions this way provides you with a detailed, comprehensive view of your financials-one that you couldn’t get using simpler systems like single-entry. There’s one more common accounting term you should know here: chart of accounts, which is a big list of all your accounts (what kind of transaction in your business is an asset, what’s a liability, what’s an equity, etc.).

#Doubl entry bookkeeping examples trial

If done correctly, your trial balance should show that the credit balance is the same as the debit balance. All these entries get summarized in a trial balance, which shows the account balances and the totals of your total credits and total debits. When making these journal entries in your general ledger, debit entries are recorded on the left, and credit entries on the right. Each accounting entry affects two different accounts: for example, if you sell a cup of coffee, your cash account goes up, and your inventory account goes down. Every financial transaction gets two entries, a “debit” and a “credit” to describe whether money is being transferred to or from an account, respectively. Double-entry accounting is a method of bookkeeping that tracks where your money comes from and where it’s going.

0 kommentar(er)

0 kommentar(er)